The Spirit of Private School’s in India

- Vinod Kakumanu

- June 9, 2025, 12:26 p.m.

With over 250 million children studying in schools, India has the world's largest K–12 student population. Yet, the education system remains unequipped and unable to skill generation alpha and beta. Despite all attempts to modernise through initiatives like NEP 2020 and the RTE 2009, school education in India leans towards rote learning, rural-urban disparities, compartmentalised curriculum, capacity building and teacher shortages. The online education technology bloomed during the COVID-19 pandemic but failed to scale post the pandemic.

India's K–12 school education market is projected to reach USD 125.8 billion by 2032, covering school curriculum, infrastructure, technology, training, and assessments. Affordable government-aided institutions and private schools are the underserved segments. Developing national digital frameworks, state-backed reforms, and parental aspirations are creating a higher challenge and larger demand for scalable and result-driven school education.

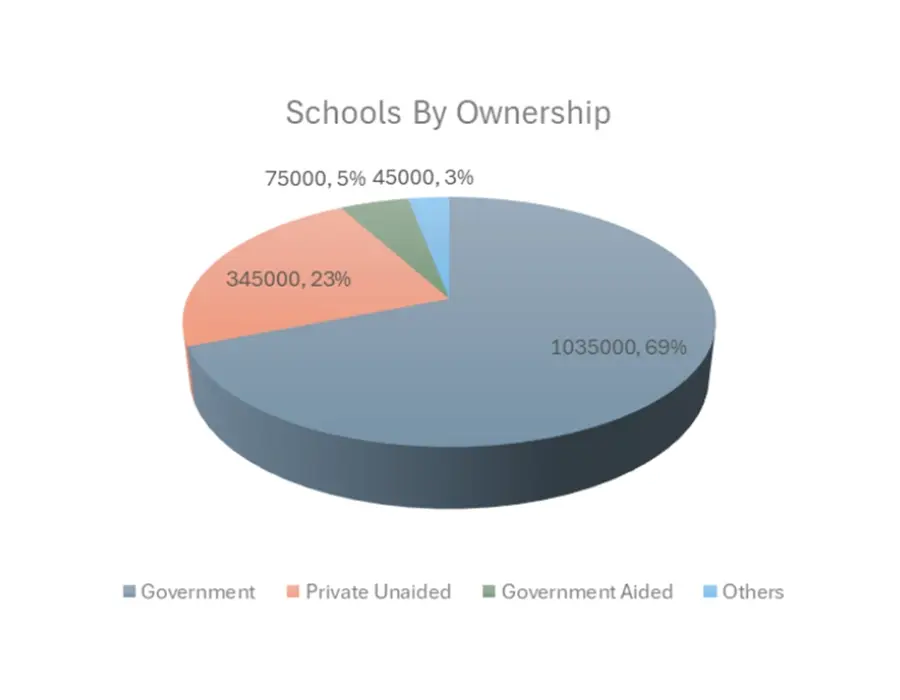

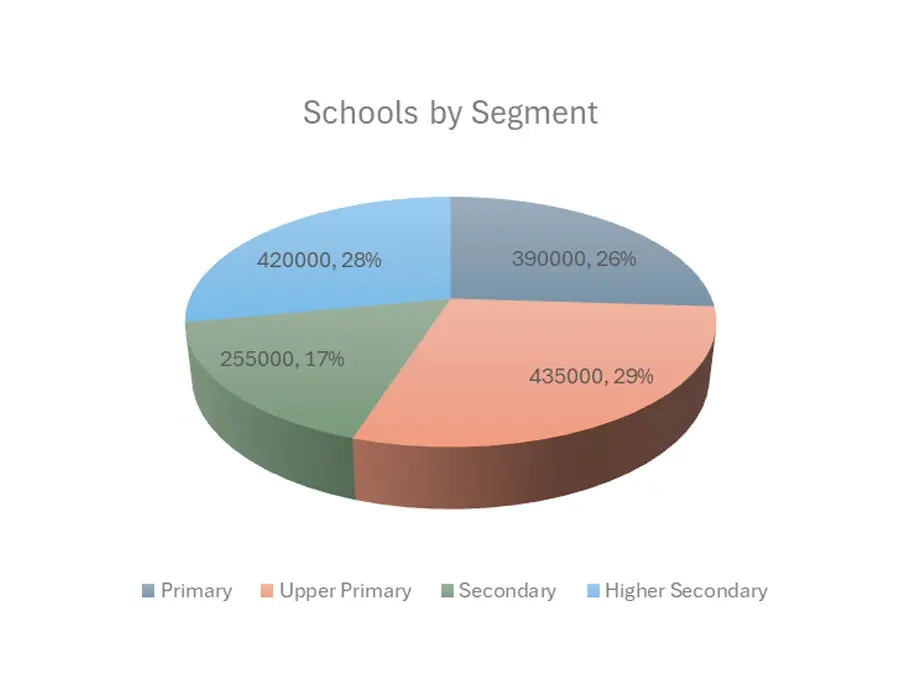

K–12 education sector is one of the most dynamic markets in the world with over 250 million students, 9.5 million teachers and 1.5 million schools of which 23% (~345,000) are private unaided schools, 69% are government schools, 5% are government aided schools and 3% others - this is as of Dec 2024. This unique scale is balanced by a strong national cause toward the shift forced by landmark policies.

The opportunity to lift up accessibility and quality remains huge, especially throughout the private and public school sectors. Technology adoption grew from 19% to 34% in recent years, with substantial room for innovation.

A near-accurate gender parity index of 1.01 emphasises the extending reach of education, and gross enrolments have steadily increased at a 1.8% CAGR.

The curriculum, reclaimed under the National Curriculum Framework, aims to transform India from rote learning toward competency-based education. Merely, significant gaps remain in critical thinking, teacher capacity building and life skills development.

With 100% FDI in education, regulatory reforms, and an increased appetite among Indian parents for premium benchmarked education, the number of international school brands has increased. Global names such as King’s College, Wellington College, and Harrow International School have set up campuses in India, and platforms such as Nord Anglia, Lighthouse, and GSF are scaling quickly. Supported by operational efficiencies and private equity interest through technology adoption, these platforms are experiencing expansion and a sharp ROI.

Despite this progress, systemic demands like high dropout rates at higher secondary levels (13%), patchy digital readiness and infrastructure gaps are making scalable invention crucial. India’s developing educational landscape provides investors with an unparalleled opportunity, such as a favourable policy environment, increasing consumer ambitions, and a quickly emerging need for quality education.

India’s developing educational landscape provides investors with an unparalleled opportunity, such as a favourable policy environment, increasing consumer ambitions, and a quickly emerging need for quality education.

India’s private school market endures at the turning point of a transformation forced by policy changes, increasing parental expectations, and extending digital infrastructure. As challenges remain in quality, scalability and accessibility, the impulse toward invention and reform is undeniable. Investors who strategically align pedagogy, technology and investment can form a more future-ready education system to deliver significant social and economic value.

Your School’s Growth Partner from Concept to Campus. Contact us to Ignite a new era of effective learning that prepares India’s next generations to flourish internationally.

Write to our School Consultant: